European

Nuclear Society

e-news

Issue 28 Spring 2010

http://www.euronuclear.org/e-news/e-news-28/enusa.htm

Since it was founded in 1972, the history of Enusa Industrias Avanzadas has run parallel to that of the Spanish nuclear sector. As a public company whose objective is to provide products and services to Spanish nuclear power plants, Enusa has always needed to achieve excellence in order to compete with much larger companies and show the flexibility needed to equip itself with diverse technologies. The company’s evolution in relation to the fuel cycle can be divided into three major stages:

From 1972-1984, Enusa’s business was characterised by rapid development in line with the growth driven by the PEN (National Energy Plan) in the 1970s.

From 1984 to 1991, it consolidated its position as a fuel manufacturer with the start-up of operations at the Juzbado fuel factory in 1985, which supplies fuel to Spanish reactors.

Early in the 1990s, Enusa decided to expand abroad in order to position itself in the European fuel market and to make the most of its technological and manufacturing capabilities.

At present the so-called nuclear renaissance opens up new development opportunities to the sector’s companies and at the same time requires levels of quality and efficiency that are typical of consolidated companies.

The nuclear fuel market has its own particular characteristics that differentiate it from other markets. These characteristics are fully applicable to the European context in which Enusa primarily conducts its business. First of all, it is a fundamentally technology-based market since the fuel should be designed for the specific operating conditions of each reactor. Secondly, it is a continental market in which the fuel is supplied almost exclusively from facilities located in the same geographical location (continent). In this respect, it should be noted that, as opposed to the traditional tendency to contract fuel from the national supplier (in Western Europe there are nuclear fuel factories in France, Germany, United Kingdom, Spain and Sweden), in recent years we have seen a growing tendency to contract from non-national suppliers. This is a clear sign of maturity and also of another market characteristic – its highly competitive nature (both in terms of technology and prices) due to excess installed capacity. This means that the suppliers are continuously improving and optimising their designs and processes in order to meet market demands and to boost their competitiveness.

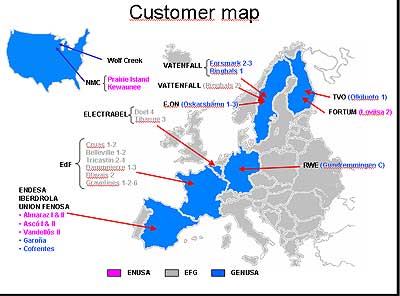

In addition to supplying fuel to seven of the eight Spanish reactors, Enusa currently supplies fuel to Finland, Sweden, Germany, Belgium and France. It has also supplied fuel to other European countries and to the United States. For example, in 2008 approximately 60% of the Juzbado factory’s production was destined for export.

Enusa has achieved this international presence basically thanks to two partnerships. In 1991, it formed the European Fuel Group (EFG) with Westinghouse to market PWR fuel in European markets. Similarly, in 1996 it created GENUSA with General Electric for the purpose of marketing BWR fuel. EFG and GENUSA have been, and still are today, very effective tools for competing in the European market and strengthening the integration of Enusa and its American partners.

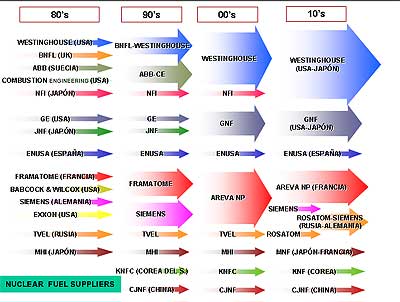

The core business of the company is nuclear fuel design, manufacture, services and marketing. The nuclear sector, more specifically the European market, is controlled by a very small number of players. In addition, Enusa’s competitors not only have capabilities in the front-end of the nuclear fuel cycle, but are also very vertically- integrated companies.1 They own the original technology of the nuclear power plants and, in some cases, are licensees of the technology used by Enusa. For this reason, the situation is complex. Because the market is very dynamic and is continuously consolidating it is also changeable.

The market for light water reactor fuel can be subdivided into two main categories: fuel for pressurised water reactors (PWR) and fuel for boiling water reactors (BWR). An analysis of the competition should, therefore, refer to each of these two technologies on a differentiated basis.

After the merger of Framatome ANP and Siemens in 2001, which gave rise to the Franco-German conglomerate AREVA, AREVA became the dominant player in Europe in terms of PWR technology. Its activities cover the whole nuclear fuel cycle and the company provides the technology for plants in France and Germany – the two leading European markets. The market conditions and the actions taken by Enusa in the early 1990s opened up the French market to competition, which allowed another major player to enter the European market, Westinghouse. Together with Westinghouse Enusa again gained a foothold through the EFG. This group is today the only technology alternative to AREVA in the area of PWR fuel in Europe and currently controls 25% of the market (with a clear upward trend in share control foreseen in the years to come).

Siemens has recently announced its intention to dispose of its percentage shareholding in AREVA and its participation in a new partnership with the Russian conglomerate ROSATOM. The consequences of this move will have a profound influence on the European market in the future.

The competitive scenario in the BWR market is more complex. Three suppliers dominate the European market. After the integration of the Swedish company ABB Atom in 2000, Westinghouse entered the BWR market. For historical reasons – Enusa’s BWR technology had come from General Electric since the 1970s – Enusa is also present in this market through GENUSA. The third player, AREVA, markets its BWR products thanks to the technology provided by Siemens. Since the BWR market is much smaller in size than the PWR market and since there are three technological options, the competition is very intense. GENUSA is well positioned in this contest and expects to cover a third of the market in the future.

Although the European market is a mature, highly-regulated market it continues to appeal to other companies from the sector that still do not have a foothold in it. The market itself accommodates new players because technological diversity favours competition both in terms of price and the technological capacity of the products. It would not be surprising if new suppliers were to emerge in the future, mainly from Eastern Europe and Asia. These would gradually penetrate the market thanks to their low labour costs.

As mentioned before, Enusa’s competitors are vertically-integrated companies that are much larger and are in control of their own technological developments. Compared to these leading players, Enusa is a sort of rara avis because, until now, it has managed to remain on the sidelines of the above-mentioned consolidation processes.

Within this context, the relevant role that Enusa plays in the European market is remarkable. If we analyse the reasons that have contributed to its privileged position, we come to the following conclusions:

The presence of a supplier like Enusa adds competition to a mature market, such as the European one.

The proven ability of its engineers to undertake complex projects in the area of manufacturing and services adds indisputable value to the company and is recognised by the market.

The capacity to manufacture various fuel designs – PWR, BWR and VVER – in a single facility enables the company to cover practically the whole market.

Enusa has had the necessary flexibility to understand market demands and propose the best solutions. This is something that is highly regarded by the operators of nuclear power plants.

The policy of focusing on the customer, which it implemented some years ago and has extended to all levels of the organization, has yielded results and has become one of the company’s major assets.

If current conditions are maintained it is likely that the market will reward the presence of suppliers such as Enusa. Obviously it is the company’s responsibility to respond to this trust by upholding high standards of quality, reliability and safety, both in its operations and in the products and services it provides.

With a nuclear renaissance currently in progress Enusa is using partnerships to position itself in new emerging markets and thereby to expand and optimise its resources. The best example of this is the Spanish Nuclear Group for China, which is mentioned later in this report.

Highly-specialised companies such as Enusa usually promote their activities at trade shows and industrial conferences and by submitting articles to journals specific to their sector. Enusa takes part in both highly technical congresses and in other meetings with a broader focus. These events are usually held on a yearly basis.

Of note is the company’s participation in the most important conference on fuel cycle companies (Top Fuel), in the European Nuclear Conference (ENC) and in the Public Information Materials Exchange (PIME) meeting that focuses on external communications. Most of these conferences are held in Europe and the United States. Some are occasionally held in Spain, but even then the international presence is very relevant.

Enusa also takes part in trade shows in the emerging markets, where it has interests, e.g. in China, where it is present through the Spanish Nuclear Group for China (SNGC). Enusa attends the International Exhibition on Nuclear Power Industry and the Nuclear International Conference (NIC) trade show.

The company participates in these forums in several ways, from presenting technical papers to running exhibition stands.

In addition to tradeshows and conferences Enusa also submits work to certain sector publications such as Nuclear Engineering International, a world reference publication in the nuclear sector.

Enusa had an international business vocation from the start. It is a well-known fact that Spanish nuclear development received invaluable help from the nuclear powers of the day and especially from the United States. It is, therefore, not surprising that Enusa received the technology for the design and manufacture of nuclear fuel from Westinghouse and General Electric (thanks to license agreements it signed with each company in 1974 ) for pressurised water reactor fuel and boiling water reactor fuel, respectively. These partnerships provided the main technological foundations for Enusa and are one of its major assets. This fact indirectly helped to maintain the presence of the American nuclear fuel technology in Europe, in direct competition with other European manufacturers which, at that time, had a high degree of independence because they were autonomously developing the technology. They have, therefore, been a key to maintaining a highly competitive European market by enabling the operators of nuclear power plants to choose between several technology options. This is not easy in a mature, highly-regulated market with very close ties to local suppliers.

The technology agreements with Westinghouse and General Electric offered Enusa engineers their first opportunity to gain international experience through extensive periods of training in the United States. During this time, they acquired the basic know-how to develop the refueling design technology that would soon be implemented in Spain. In parallel, the construction project for the Juzbado (Salamanca) factory also involved trips by Enusa personnel to receive the training required to execute the project.

In 1988, Enusa, together with General Electric, won its first fuel supply contract for a non-Spanish power plant (Leibstadt, Switzerland). The workload of the Juzbado factory progressively switched from a supply exclusively destined for the national market to a supply with an increasingly relevant export volume. This explains why Enusa, together with its American partners, decided to implement a new commercial structure more suited to the new markets, a goal that was achieved with the constitution of the aforementioned EFG with Westinghouse and GENUSA with General Electric.

Entry into the European market meant that Enusa had to adapt to be able to operate within a framework of new regulations, new requirements and new regulatory authorities. The experience gained from this was very important for maintaining the company’s competitive potential in the future. An important accomplishment in this respect was the licensing of in-house design codes by European regulatory bodies.

Another relevant milestone, in 1991, was the company’s “internationalization” process which culminated in the signing of a Technological Cooperation Agreement with Mitsubishi Heavy Industries (MHI) of Japan. Thanks to the cooperation with MHI Enusa (and hence the Spanish nuclear market) was able to take part in the development of new fuel cladding materials. The cooperation involved working together on activities ranging from testing before manufacture to the hot cell testing of the materials after irradiation in power reactors, specifically at the Vandellós-II NPP (the High Burn-up Project) and the Almaraz NPP (Advanced Cladding Project). The leadership and the know-how gained from these development projects by Enusa’s Product Engineering Department proved very valuable, enabling the company to learn state-of-the-art of fuel pellet and rod designs and understand their operational performance under highly demanding irradiation conditions.

Research, Development and Innovation (R&D&I) is one of the areas in which Enusa has focused its investments. It currently accounts for more than 6% of its annual fuel sales. R&D&I plays a role in a multitude of international programs such as HALDEN, NFIR, ROBUST Fuel, CABRI and ALPS, and it is also a shareholder in the Jules Horowitz (JHR) research reactor project in France. Also of note is the close collaboration in research projects of Enusa’s Engineering Department with the Electric Power Research Institute (EPRI).

Starting with the basic know-how obtained during the first phase of development, these capabilities have been consolidated and enriched as the company participates in new fuel supply projects and new R&D&I projects. The Enusa Engineering department became a recognised resource that was highly regarded by its customers and partners, and it progressively received more ambitious requests for collaboration. For example, Enusa technicians participated in the development of the Westinghouse reactor AP600, advanced safety assessment methodologies and the General Electric reactor ESBWR licensing process. At present, the Core Engineering department is carrying out safety assessment studies for American power plants commissioned by its partners. These studies will prove useful for purposes such as plant power uprates and modifications in the operating strategies, both of which must be audited and approved by the Nuclear Regulatory Commission (NRC).

As indicated above, the last phase of this internationalisation process is linked to the nuclear renaissance and is a direct consequence of the need for cooperation among sector companies. This has led to the creation of the Spanish Nuclear Group for China (SNGC), incorporated in 2008 thanks to shareholdings by the following Spanish companies: Equipos Nucleares (ENSA), which belongs to SEPI; the nuclear services firm TECNATOM; RINGO Válvulas and Enusa Industrias Avanzadas, S.A. This budding enterprise is in the midst of an ambitious development plan in China and has already signed the first collaboration agreements with a Chinese nuclear fuel manufacturer and with other engineering and manufacturing firms in that country. 2010 should see these projects bear fruit and consolidate SNGC as an alternative goods and services supplier. It should also see support given to the challenge of how to increase the capacity of the Chinese nuclear fleet from its current 11 GWe to 70 GWe of installed nuclear capacity by 2020.

Also in Asia, South Korea is a country with one of the most highly- developed nuclear industries outside of Japan. The Korean fuel manufacturer, Korean Nuclear Fuel (KNF), and Enusa have developed their relations over the years and collaborated in fuel performance-related activities. In 2009, relations were strengthened with the signature of a collaborative agreement that covers new areas of cooperation between the two companies.

It should also be noted that fuel and equipment transport services are provided by Express Truck, S.A. (ETSA), a subsidiary of Enusa that has considerable experience as an international multi-modal carrier. ETSA has also begun to expand internationally with the establishment in Romania of its subsidiary ETSA Doi. In this way it aims to develop a business model in Eastern Europe similar to the Spanish one. It also aims to position itself in the European market as a leading operator for International Carriage of Dangerous Goods by Road (ADR) by having service platforms at both ends of the continent.

1 These are companies with a presence in both the front-end and back-end of the nuclear fuel cycle.

![]()

© European Nuclear Society, 2010