European

Nuclear Society

e-news

Issue 6 Autumn 2004

http://www.euronuclear.org/library/public/enews/ebulletinautumn2004/listening.htm

The use of the word “creative” in the title of

this article is inspired from the well-established phrase “creative accounting”.

According to Wikipedia, an Internet encyclopædia, creative accounting

refers to accounting practices that deviate from the standard ones. In particular,

it can be used to refer to systematic misrepresentation of the true income and

assets of business organisations.

As we shall see shortly, creativity in this sense is not restricted to accounting.

My attention was recently drawn to a graph published in January 2004 by the

American magazine Windpower Monthly1. The said graph purported

to plot the price of wind power against coal, gas and nuclear. Its objective

was to show that wind energy is becoming competitive with the cheapest non-renewable

energy sources. One would think that this is a tall order. Not if you have sufficient

imagination. The way in which the task was tackled makes it worth while analysing.

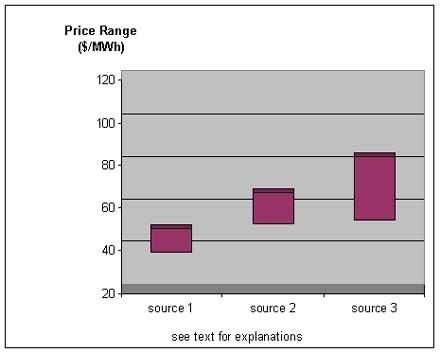

Since I do not wish to infringe any copyrights, I shall proceed in three steps

using my own graphs. First, one must prepare a bar chart showing the price ranges

in $/MWh for the three non-renewable energy sources. Energy sources 1, 2 and

3 are supposed to stand for gas, coal and nuclear respectively. Here already,

one might question the figures chosen: no source is given for the price ranges

considered. They might apply to the US context, but are certainly not valid

for EU countries, as testified by numerous studies and the recent Finnish decision

to build Finland 5. I shall not spend more time on this issue in order not to

deviate from the point I am trying to make. Let us just note that gas would

come out cheapest and nuclear most expensive, both as regards the bottom and

top ends of the ranges, as shown in fig 1.

figure 1

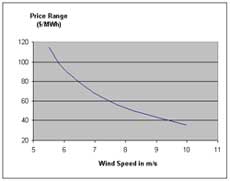

One then proceeds to plot the cost of energy produced vs. the wind speed. It

can be easily shown that the energy converted into electricity E is proportional

to the third power of the wind speed. If we consider that the only generation

cost involved is the investment needed to build the wind machine, then the cost

per MWh produced c is equal to this investment divided by E. This entails that

cost c is inversely proportional to the third power of the wind speed.

Such relationship explains why cost c decreases rapidly when the wind speed

increases, as shown in fig 2.

figure 2

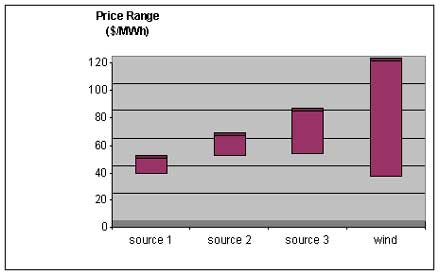

Now comes the last and most interesting part of the exercise.

Since the unit cost of wind electricity also varies in the present case, one

just has to call it price range. One is then able to take advantage of the commonality

of the variable plotted along the vertical axis to combine the two graphs into

a single picture.

Before doing so however, the truly creative person will however tilt the bar

chart at a suitable angle so as to enhance the impression of escalating costs

with the non-renewable energy sources. The final result is shown in figure 3.

|

|

figure 3

Putting the two graphs side by side then enables one to claim that with an average wind speed above 8 m/s, wind electricity competes cost-wise with the best gas plants.

It might be true that the best wind farms deliver electricity

that is less costly than the electricity produced by the best gas plants. Decisions

however are not made on the basis of the exceptional, but on the basis of the

likely. And the least one can say is that the likely is not to be found in figure

3.

On the non-renewable side, price ranges have been displayed to translate the

impact of the variation of a large number of parameters (erection and maintenance

costs, fuel price, discount rate, etc.) on the cost of electricity.

What has been done on the wind side is quite different: one has plotted the

consequences in money terms of the physical law linking the energy produced

to the wind speed. Had one treated wind in the same way as the non-renewables,

one would have obtained something similar to figure 4. The cheapest wind electricity

would still beat the best performing plants using non-renewable energy sources

(assuming the figures used are reliable), but the true message depicts a much

more complex reality than in figure 3.

figure 4

Overlooking the fact that the optimal wind conditions are actually

in short supply, both time-wise and space-wise further skews the comparison.

The worst in my view however is that the “clever” layout adopted for figure 3 will lead the non-specialists to associate non-renewables with high costs and wind energy with low costs. Things are far from being that simple: if wind energy was so cheap, why not go for 100% wind electricity? In a similar vein, just swap the positions of sources 1 and 3 in figure 3: what is left from the “demonstration”?

It is a pity that the wind industry tolerates such pieces of inaccurate reasoning in its reports. Due to its intermittent nature, wind energy absolutely needs to be backed up by steady energy sources. Among them, nuclear is the only one that, like wind, does not generate carbon dioxide. The case of wind energy only confirms the validity of the energy mix concept and the need to include nuclear in the said mix.

Let us nevertheless conclude on a more positive note. Next time your neighbour

tells you it’s now been established that wind power is competitive with

the best non-renewable power plants, you’ll know why (s)he might be absolutely

sincere.

1 A copy of the graph can be found on the Internet on page 73 of “Wind Force 12” (http://www.ewea.org/documents/WF12-2004_eng.pdf), a report published in May 2004 by the European Wind Energy Association (EWEA). To be complete, it must be added that the cover page of the document also bears the Greenpeace logo.

![]()

© European Nuclear Society, 2004